SoloCopertine - Il blog di SofyElle - Pagina 2 di 8 - Copertine a uncinetto con schemi e spiegazioni

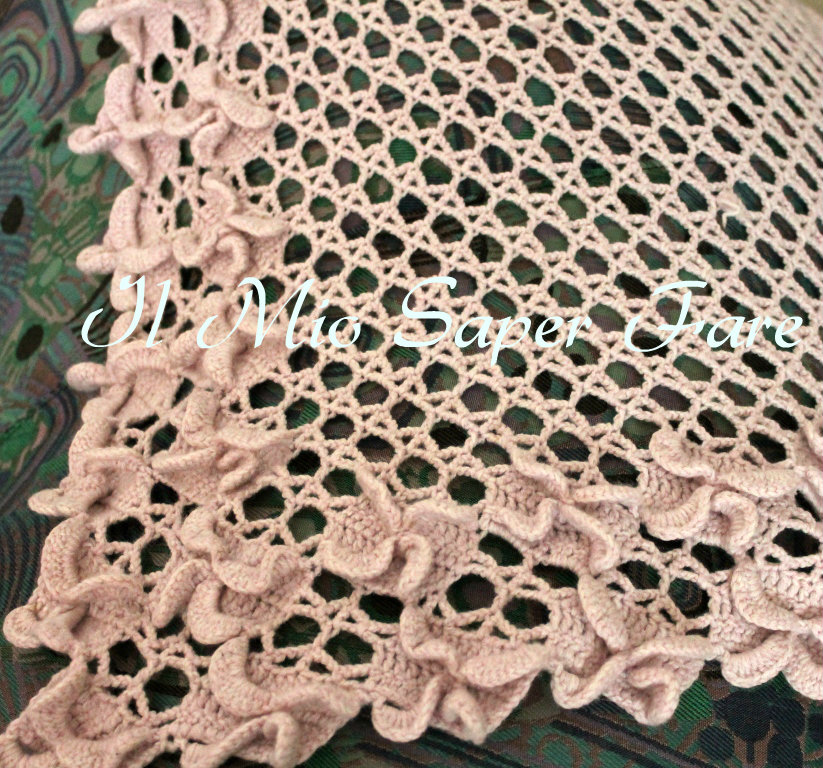

Scialle con motivi a V e ventaglietti | I gomitoli di Camilla-Creativity Blog | Crochet shawls and wraps, Crochet shawl, Crochet poncho

Sfilo e Creo di SofyElle - Scialle semplicissimo con spiegazioni e schema: https://blog.pianetadonna.it/igomitolidicamilla/scialle-granny-archetti/ | Facebook

Scialle con motivi a V e ventaglietti | I gomitoli di Camilla-Creativity Blog | Scialli uncinetto, Uncinetto, Scialle