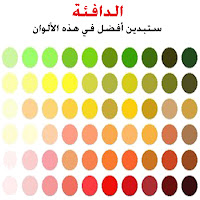

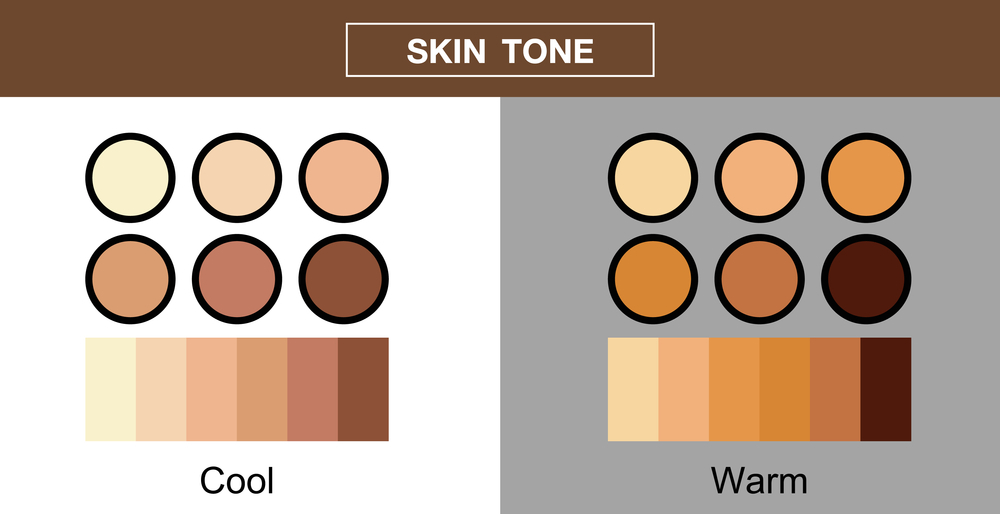

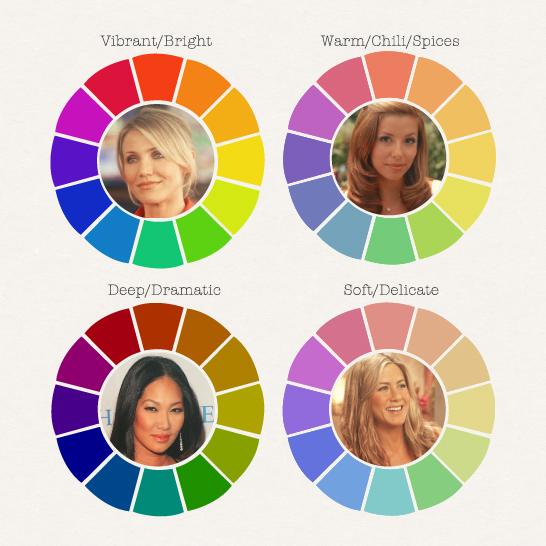

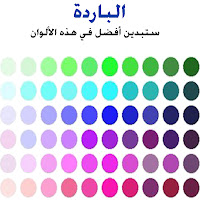

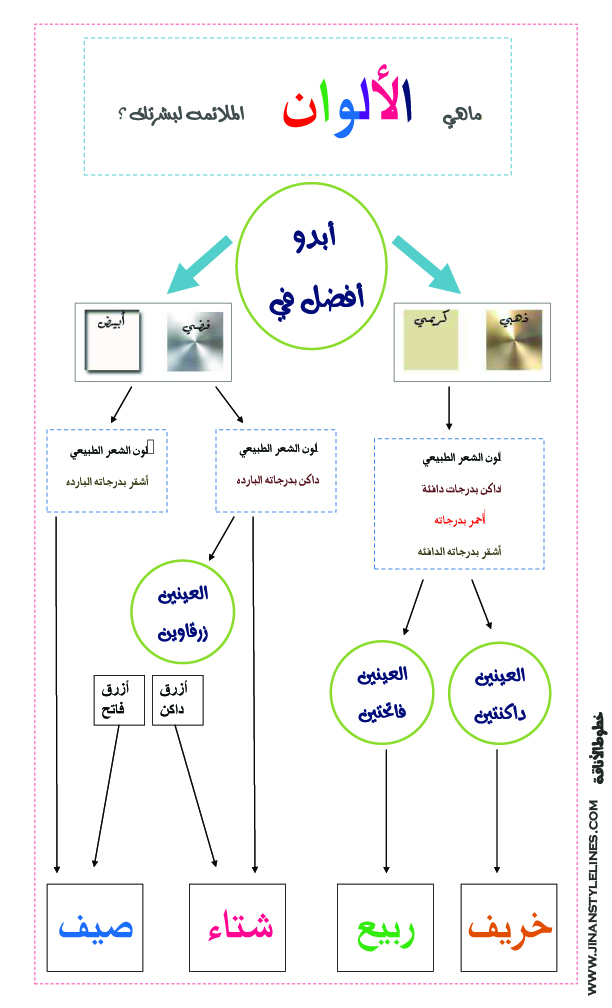

Make Up Artist Rain Sama - #skin_tones إنّ معرفة درجة لون البشرة أمرٌ مُهم بالنسبة لأيّ شخصٍ إذ يُسهّل عليه العديد من الأمور، مثل تحديد ألوان الملابس المناسبة للبشرة، كما يُحدد لون

ألوان للحجاب والعباءة قد تبدين بها باهتة.. تجنبيها! Undertone البشرة.. الخطوة الأولى لظهورك بأبهى حلّه - صحيفة الوطن

الوان الملابس او الحجاب المناسبه لكل بشره و تحديد الاندرتون 😍❤️ || شهد ناصر 🌸 #خليك_بالبيت - YouTube