Prodaja 15a regulator napetosti dc motor krmilnik dc 10v-50v hitrosti regulator led stikalo za kratke luči stikalo za nadzor hitrosti, termostat stikalo > Električna Oprema In Potrebščine < Kosilonahitro.si

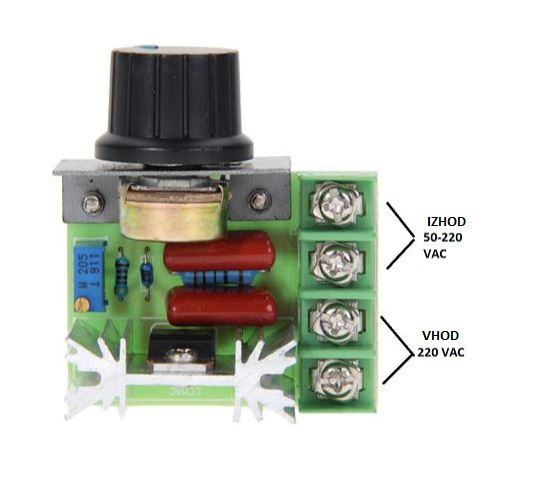

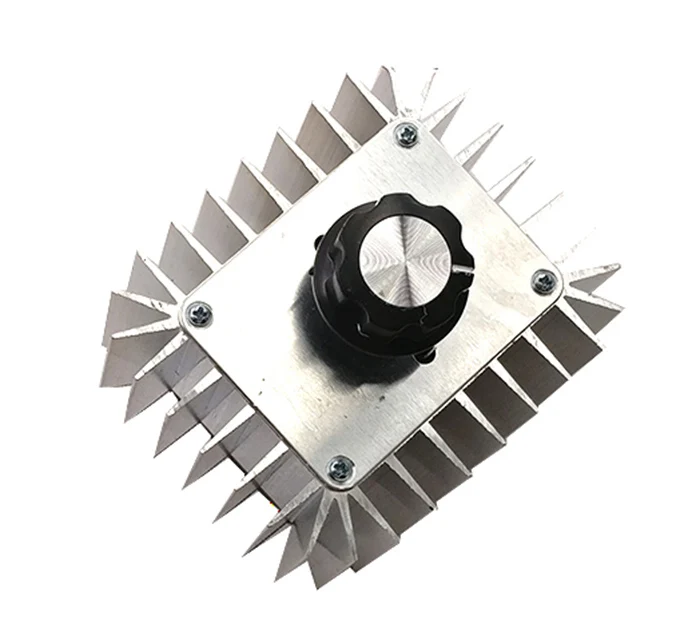

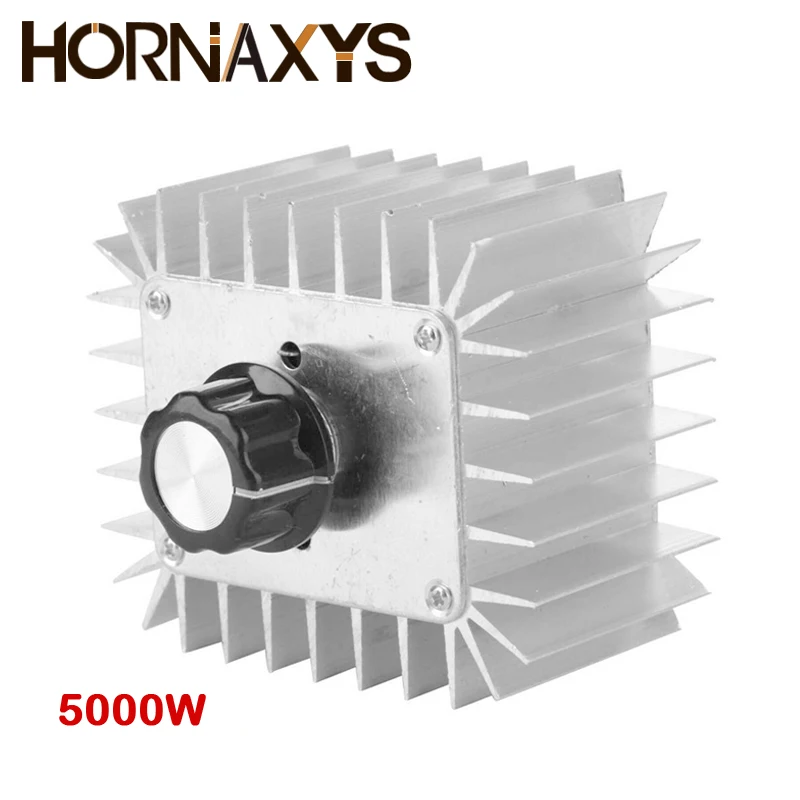

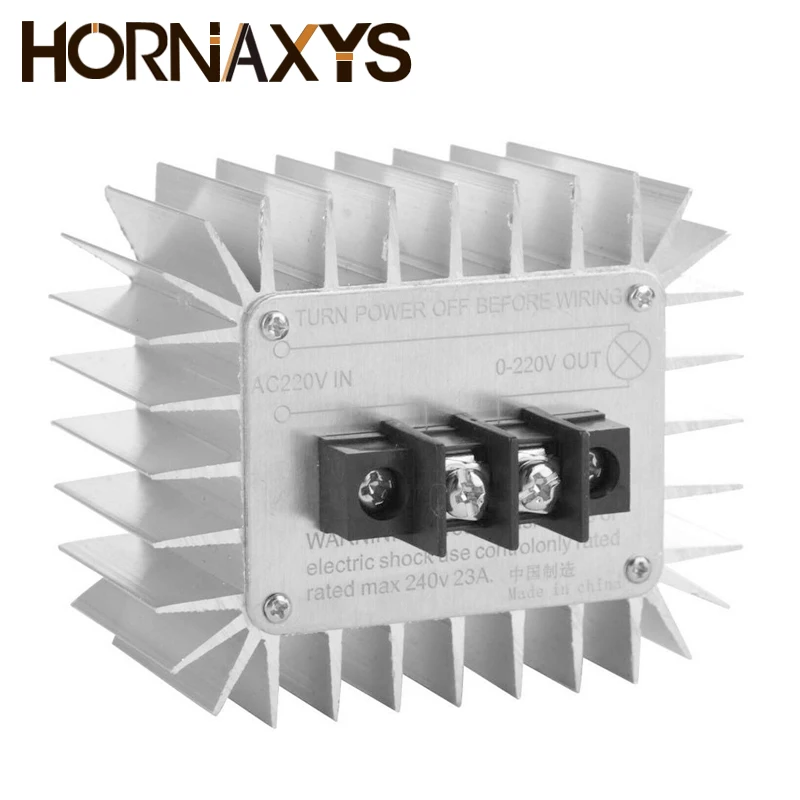

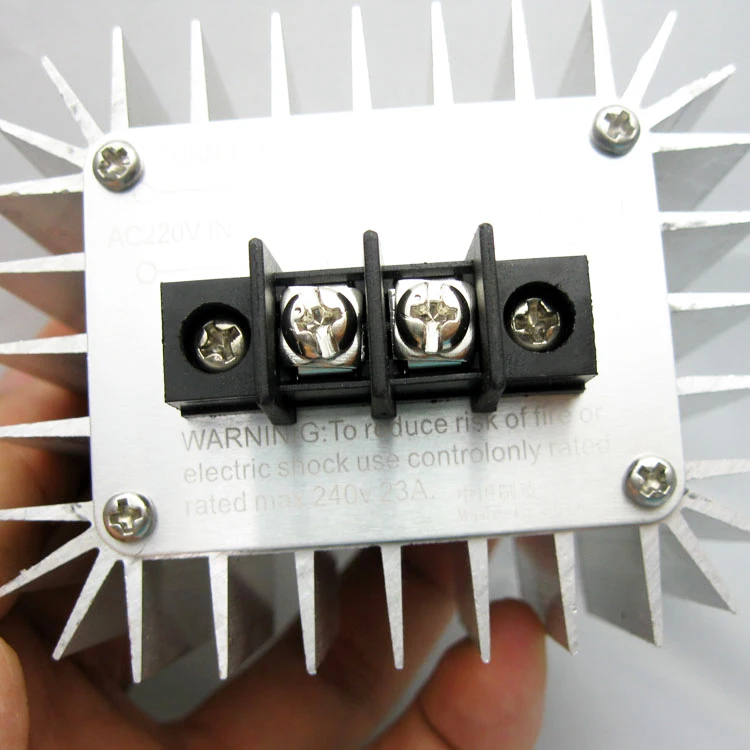

5000W 220V SCR Regulator Napetosti Motorja Krmilnik Luči Zatemnitev Senčniki Termostat Hitrosti Regulator Regulator Za LED Luči nakup / Popust \ www.kkradovljica.si

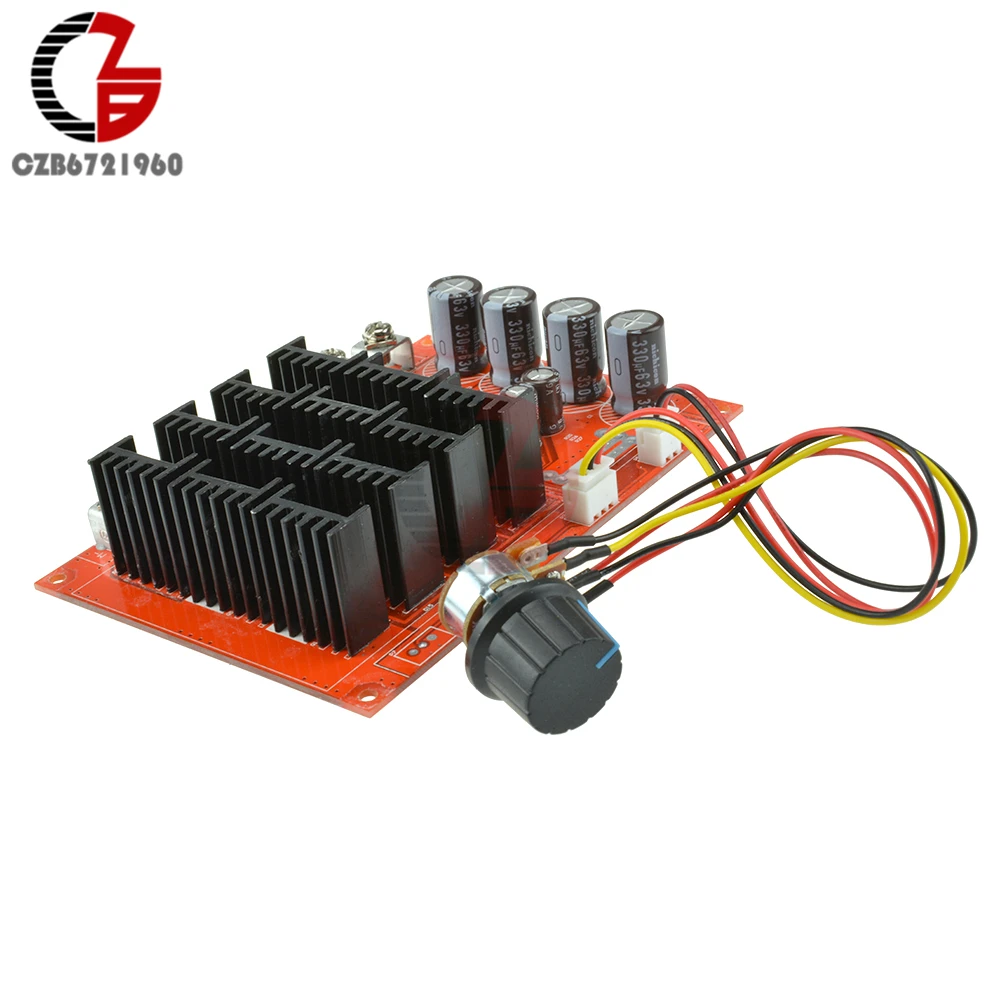

Nakup 3000W 60A 50V Krmilnik PWM Motornih Hitrosti Regulator DC 10-50V Regulator Napetosti Nadzor Stikalo za LED Luči, ki Oddajajo / Električna Oprema In Potrebščine ~ www.trboje.si

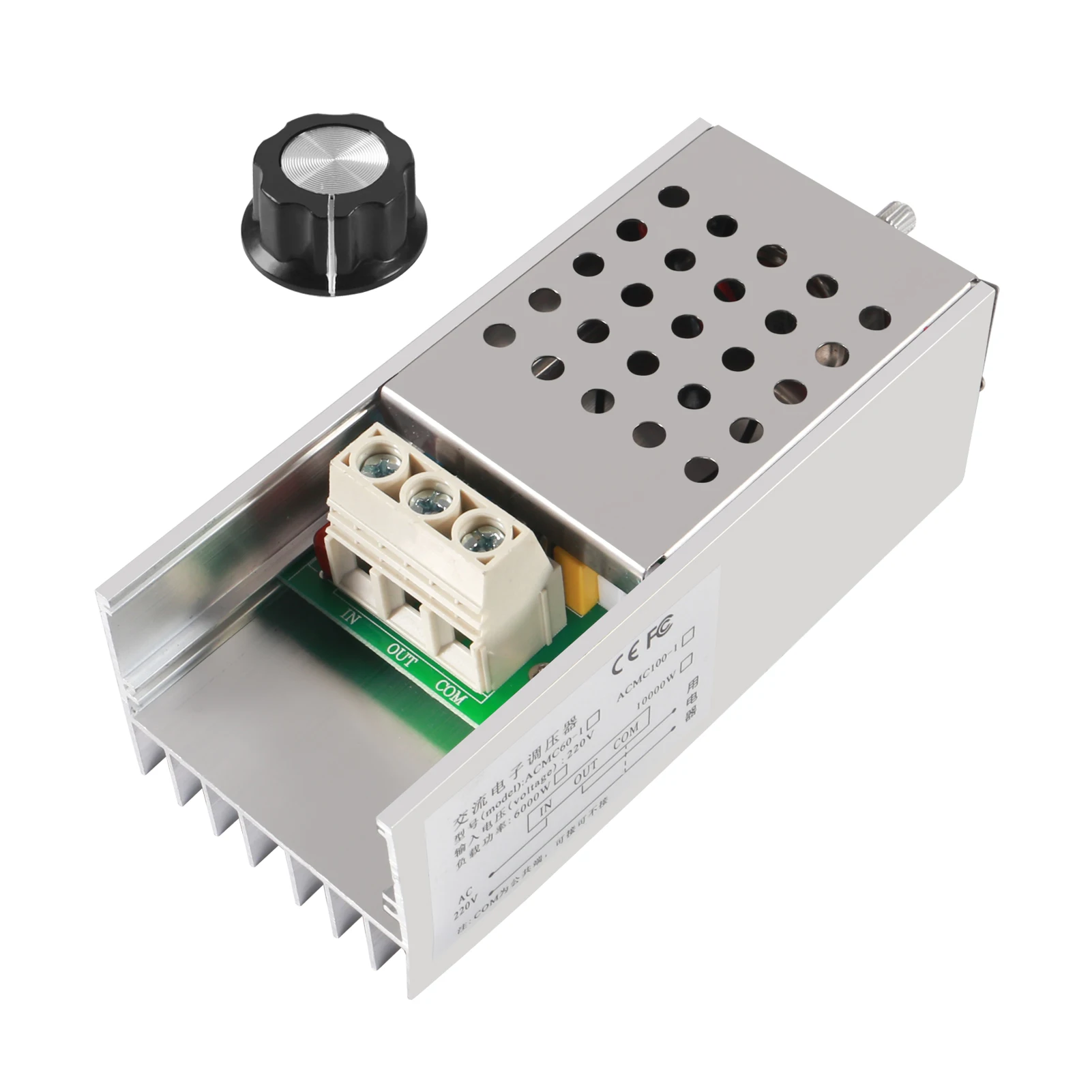

10000w 25a krmilnik high power scr regulator napetosti stikalo za kratke luči stikalo hitrost nadzor temperature termostat 110v ac 220v 4.8 Na razprodaji! / Električna Oprema In Potrebščine - Easybeer-koper.si

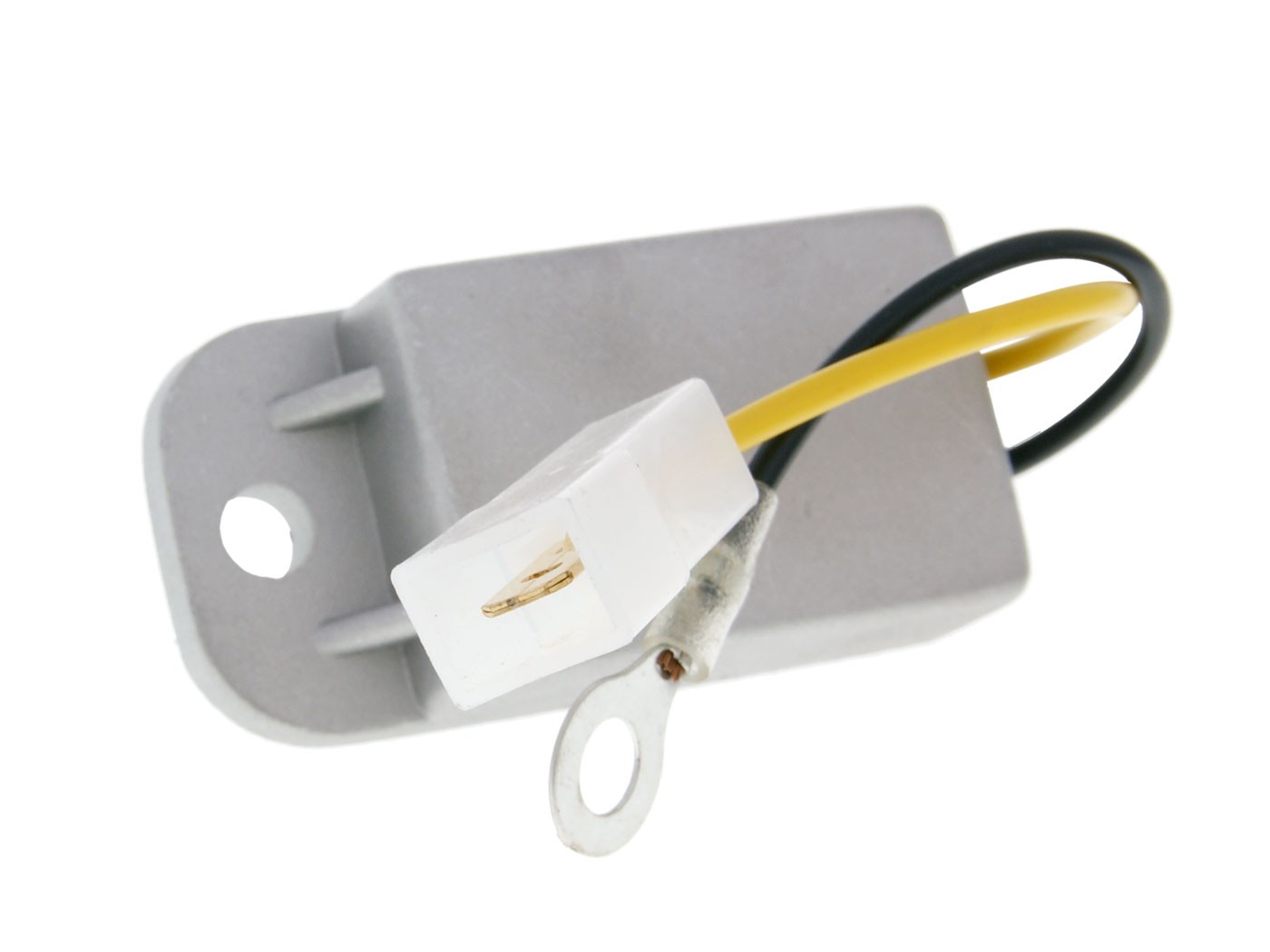

12v 24v led stikalo za kratke luči stikalo 8a regulator napetosti nastavljiv regulator za led trak svetlobe žarnice prodaja / Za Razsvetljavo Pribor | www.podroznikmozirje.si

Полуавтоматный regulator napetosti konus ktc812 magnetski regulator napetosti kočnice u prahu kupi online | Strojevi I Pribor < www.cateringkodane.com.hr

Nakup na spletu AC 220V 5000W SCR Regulator Napetosti Krmilnik Za Luči LED Zatemnitev Senčniki Termostat High Power Elektronska regulacija Napetosti \ Električna Oprema In Potrebščine - Orgon.si

4000w Ac 220v Scr Motornih Krmilnik Modul Za Regulator Napetosti Dimmer Za Električna Peč Bojler Led Luči / Električna Oprema In Potrebščine ~ www.kandare.si

5000W 220V SCR Regulator Napetosti Motorja Krmilnik Luči Zatemnitev Senčniki Termostat Hitrosti Regulator Regulator Za LED Luči nakup / Popust \ www.kkradovljica.si

LED stikalo za kratke luči Stikalo 8A Regulator Napetosti 12V-24V 8A Nastavljiv Regulator za LED Trak Svetlobe Žarnice > Za Razsvetljavo Pribor ~ www.recnik.si

5000W 220V SCR Regulator Napetosti Motorja Krmilnik Luči Zatemnitev Senčniki Termostat Hitrosti Regulator Regulator Za LED Luči nakup / Popust \ www.kkradovljica.si

Nakup 220v 5000w Scr Regulator Napetosti Motorja Krmilnik Luči Zatemnitev Senčniki Termostat Hitrosti Regulator Regulator Za Led Luči | Prodaja < www.solmar.si

AC 220V 6000W Krmilnik High Power SCR Regulator Napetosti stikalo za kratke luči Stikalo Hitrost Nadzor Temperature Termostat Z Lupino / Zabavna elektronika - Get-together.si

Akcija 5000w 220v Scr Ac Regulator Napetosti Motorja Krmilnik Senčniki Termostat Hitrosti Regulator Regulator Za Led Luči - Električna Oprema In Potrebščine \ www.slowoodlife.si

Ac220v 5000w Scr Regulator Napetosti Motorja Krmilnik Luči Zatemnitev Termostat Hitrosti Regulator Za Led Luči | Razno \ Orle.si